best cheap stocks to sell covered calls

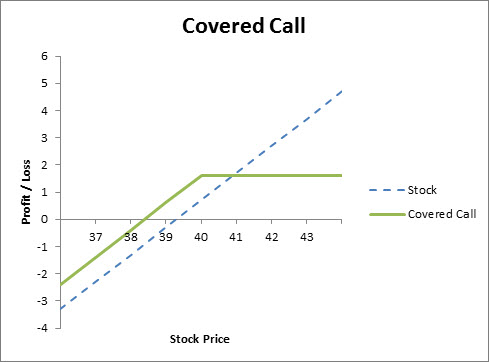

At least 10 ITM and maybe even 15 or 20 ITM. A covered call is a financial market transaction in which the seller of call options owns the corresponding amount of the underlying instrument such as shares of a stock or other.

Anatomy Of A Covered Call Fidelity

One positive of the declining stock price is a very tasty pardon the pun dividend yield which currently sits at 432.

. BofA looks at 5000 overwriting positions in the Russell 1000 NYSEARCA. This video will tell you my best stock to sell covered calls for in June 2021. Ive got about 100k to.

You could sell the 23 March 160 covered calls for 355 at last check. 120 call while selling the Aug. 20 and the covered call trade.

Discover our trading course that shows how to earn extra income trading options. The Stock Options Channel website and. This video will tell you my best stock to sell covered calls for in June 2021.

Electronics retailer has fended off e-commerce threats and its. Would You Like Expert Advice About Specific Penny Stock Tickers That Are Likely To Pop. A covered call is an options strategy in which the trader holds a long stock position and sells a call option on the same stock in an attempt to generate income.

Ultimately the best covered call options are the ones where you make money consistently. IWF with August 20 expiration. Ad Weve Helped Investors Just Like You Achieve Tremendous Gains In The Stock Market.

When traders make a case for selling long-term options against their stock positions they usually argue that the long-term approach gives them. August 20 2021 135 Call is 267 This yields about. Sell the Jumia 15 November puts for 3 using GTC order.

Berkshire stock may be the perfect stock for covered calls. KHC KraftHeinz Dividend Growth Stock Chart. Ad See how this trading course helps small investors earns Extra Income.

In a single spread trade youll buy back the APR 90 calls and simultaneously sell the MAY 95 calls. Many top the high RSI overbought lists after seeing multi. You must own at least 100 shares of a stock to write one covered call.

Oil gas and energy companies are some of the best-performing stocks over the past few months with some at our near all-time highs. A Covered Call or buy-write strategy is used to increase returns on long. OHI may not pay what DSL does.

Walmarts stock price never closed below triple digits and demonstrated good support ahead of the psychological 100 level that can help protect a covered call position. Jumia is almost flat on the RSI and MFI is showing a divergence upward that signifies developing volume strength. You get a 222 premium and keep it if it isnt called away.

The two most consistently discussed strategies are. Basically buy a LEAP itm call and sell short term slightly otm calls on it until it expires. These are two dividend stock examples that are some of the best stocks to write covered calls against.

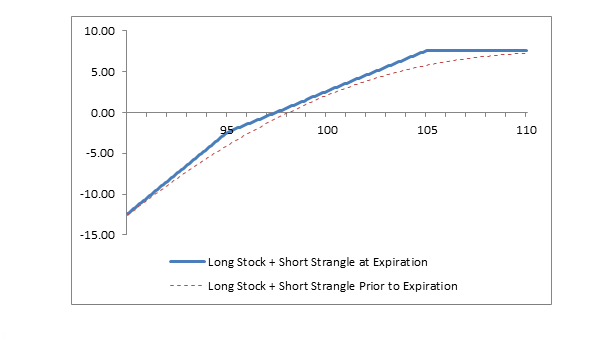

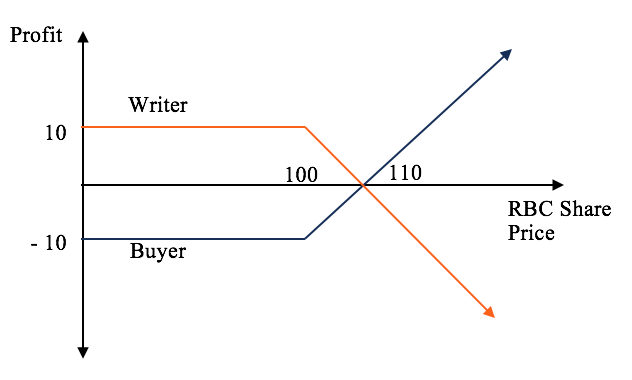

Hedge portfolio generate alpha or express a directional view on volatility. In theory on the day a company pays a dividend the stock should trade lower by the amount of the dividend because. 1 Selling covered calls for extra income and 2 Selling puts for extra income.

For a free trial to the best trading community on the planet and Tylers current home. MCD closed at 160 on Wednesday. Covered Calls Advanced Options Screener helps find the best covered calls with a high theoretical return.

But you should be aware that dividends do play a role in call option pricing. 128 call for a net debit of 495. Weeklies Covered Call Examples.

Stay on the left side of the Moneyness slider. Ad With extended global trading hours trade nearly 24 hours a day 5 days a week. I used my favorite stock screener to find this high momentum yet great value.

Of these 10 offer at least 5 premium while allowing for a. Walmarts stock price never closed below. Omega Healthcare Investors yields 69 today and its dividend is well covered by the rents of its tenants who operate skilled nursing facilities.

The Feeble Argument for Long-Term Covered Calls. If youre in a hurry below are our top picks for the best stocks for covered call writing. Cost of your call has to be strike price difference.

Weed stocks are all cheap. Here are a few recent strike prices that are offering a reasonable premium while still allowing for some price appreciation. When traders make a case for selling long-term options against their stock positions they usually argue that the long-term.

You buy 100 shares of stock and sell near month 105 call at 125 if you think the stock will go up but want benefit of decent. A neat little strategy is the poor mans covered call. XYZ stock at 100.

Options Calls And Puts Overview Examples Trading Long Short

:max_bytes(150000):strip_icc()/NakedCallWriting-AHighRiskOptionsStrategy1_2-8d43ff7033cb47eca5d0954fab5c2d94.png)

Naked Call Writing A High Risk Options Strategy

How To Trade Options Making Your First Options Trade Ticker Tape

/10OptionsStrategiesToKnow-01-10080bc58b164d78b262547662532504.png)

10 Options Strategies Every Investor Should Know

Uncovering The Truth About Covered Calls Reuters Covered Calls Truth Things To Sell

Call Option Understand How Buying Selling Call Options Works

How To Use Covered Calls For Income 2020 Youtube

/TheBasicsofCoveredCalls-e9b54e56a9c74812b728f6c4585e4192.jpg)

Covered Calls Basics Risks Advantages Overview

Covered Call Definition Practical Example And Scenarios

/close-up-of-stock-market-data-on-digital-display-1058454392-9e48e65462e14a04a74008cbe0ec9aa9.jpg)

Covered Calls Basics Risks Advantages Overview

:max_bytes(150000):strip_icc()/TheBasicsofCoveredCalls-e9b54e56a9c74812b728f6c4585e4192.jpg)

Covered Calls Basics Risks Advantages Overview

/TheBasicsofCoveredCalls-e9b54e56a9c74812b728f6c4585e4192.jpg)

Covered Calls Basics Risks Advantages Overview

:max_bytes(150000):strip_icc()/CoveredCall-943af7ec4a354a05aaeaac1d494e160a.png)

Put Option Vs Call Option When To Sell

/TheBasicsofCoveredCalls-e9b54e56a9c74812b728f6c4585e4192.jpg)

Covered Calls Basics Risks Advantages Overview

7 Best Options Trading Examples 2022 Benzinga

/Clipboard01-617b9d39bcc744d691fc612f569587e0.jpg)

Put Option Vs Call Option When To Sell

Wedding Budget Worksheet Free Download Excel And Google Sheets Options Trading Strategies Call Option Trading Charts

Selling Covered Calls Covered Call Strategy Selling Covered Calls Investing Strategy