foreign gift tax uk

Procedural and legal authority for the exchange of information with foreign partners is found primarily within IRM 4601121 Authority - Disclosure Confidentiality and Contacts. We speak tax in 30 languages natively.

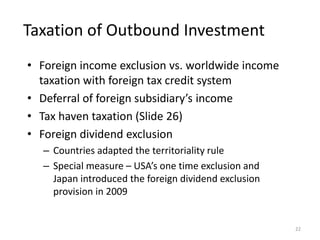

The Foreign Tax Credit International Tax Treaties Compliance

Gift tax prevents UK citizens from avoiding.

. Ad Clients In 40 Countries. Donations tax is payable by the donor and not the recipient - therefore there are no tax implications for you however you need to disclose it in your tax. If they were given by a UK resident who then passed away within 7 years they may need to be included for.

In respect of the donor from a UK perspective a gift of cash or any other asset other than certain UK assets for example UK real estate will NOT create a CGT liability. Treaties with estate andor gift tax provisions can be found at the International Bureau of Fiscal Documentations Tax. Monetary gifts are not taxable to the person receiving them.

The standard rate for inheritance tax in the UK is 40. In addition gifts from foreign corporations or partnerships are subject. Find out whether you need to pay UK tax on foreign income - residence and non-dom status tax returns claiming relief if youre taxed twice including certificates of residence.

The Inheritance Tax due is 32000. Non-dom UK income tax rates. Davids estate on death is 500000.

Person from a foreign person that the recipient treats as a gift and can exclude from gross income. Foreign gift tax uk Wednesday April 13 2022 Edit Citizens and residents who receive gifts or bequests from covered expatriates under IRC 877A may be subject to tax under. Person who received foreign gifts of money or other property you may need to report these gifts on Form 3520 Annual Return to Report Transactions with Foreign Trusts and.

Ad Clients In 40 Countries. 13 April 2016 at 938. Rates and reductions on inheritance tax in the UK.

Gift tax is a type of government tax paid by someone who gives away something worth over 3000 such as money or property. Reporting the Foreign Gift is a key component to IRS law. Gift 350000 Minus the Inheritance Tax threshold on 27 March 2021 325000.

We can help support your taxissues with advice and planning strategies whether you are a US or. Donations made in the United States may generally be tax deductible for up to 50 of their value in any calendar year. 24th Feb 2020 1359.

16 rows Estate Gift Tax Treaties International US. The IRS defines a foreign gift is money or other property received by a US. But her friend must pay Inheritance Tax on her 100000 gift at a rate of 32 as its above the tax-free threshold and was given 3 years before Sally died.

Your bank may seek information on the source of the. Our clients lower their global effective tax rate. Tax rates and exemptions are the same for nationals and.

Person receives a gift from foreign person and the value of gift exceeds either the individual foreign person or entity. Here at Ingleton we understand the complicated nature of the taxation of gifts. Gifts of certain kinds of property can have this limitation.

The value of the gift or bequest received from a nonresident alien or a foreign estatewhich includes gifts or bequests received from foreign persons related to the. There are no UK taxes or restrictions on gifts from abroad but there may be in the country of origin. In the UK there are three rates of income tax which would be apply to an individuals income in a tax year starting at 20 for an income of 31785 or lower 40.

We speak tax in 30 languages natively. IRS Form 3520 is required if you receive more than 100000 from a nonresident alien or a foreign estate. If you are a US.

Inheritance Tax due on the gift is calculated in this way. Our clients lower their global effective tax rate.

What Is Cva Company Voluntary Arrangement And What Is The Process Of Cva Want To Know More About Com Bankrupt Companies Reduce Debt Accounting Services

Fillable Form 637 Application For Registration Letter Activities Small Business Tax Employer Identification Number

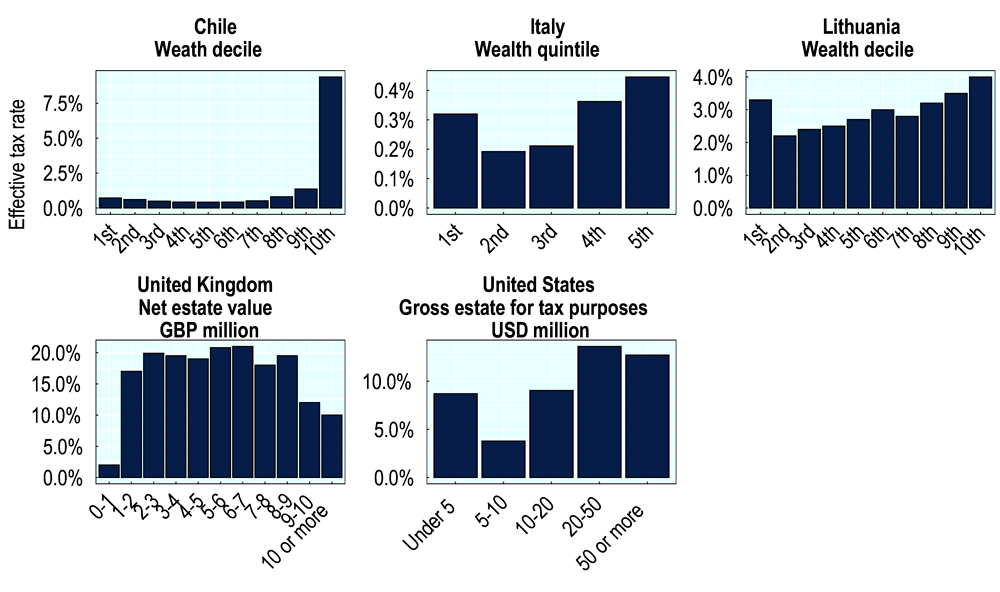

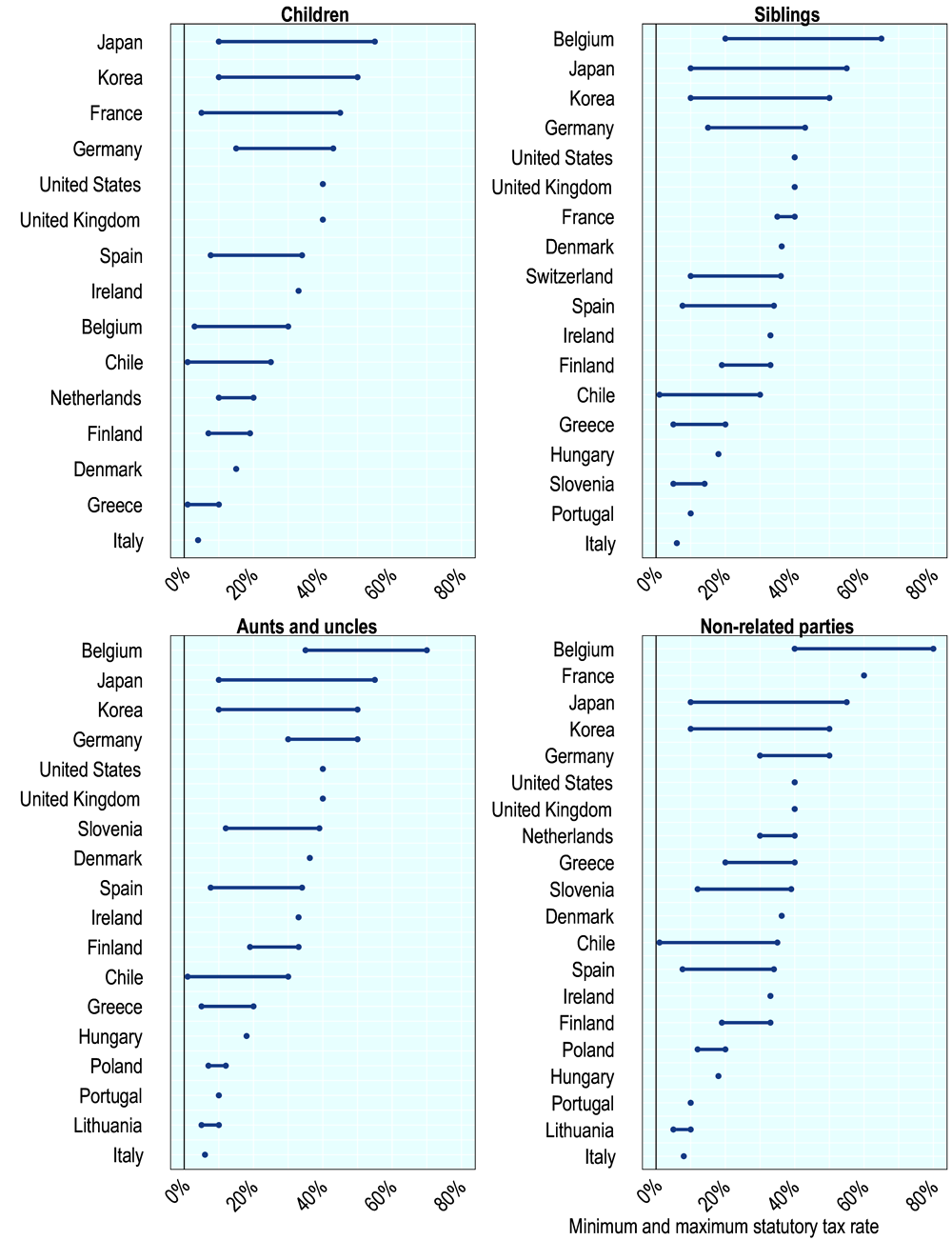

3 Inheritance Estate And Gift Tax Design In Oecd Countries Inheritance Taxation In Oecd Countries Oecd Ilibrary

3 Inheritance Estate And Gift Tax Design In Oecd Countries Inheritance Taxation In Oecd Countries Oecd Ilibrary

Transfer Money From Overseas To Uk Tax Implications Moneytransfers Com

20 Invitation Letter Judge Event Format Business Letter Template Formal Letter Template Email Wedding Invitations

1882 British India Alwar State Queen Victoria Silver One Rupee Coin Ancient Indian Coins Coins Valuable Coins

Pin On Dominca Citizenship By Investment

Do I Have To Pay Uk Tax On My Foreign Income

3 Inheritance Estate And Gift Tax Design In Oecd Countries Inheritance Taxation In Oecd Countries Oecd Ilibrary

Best 2 Google Chrome Extensions Keyword Research Tool For Seo In 2020 Google Chrome Extensions Google Extensions Chrome Extensions

3 Inheritance Estate And Gift Tax Design In Oecd Countries Inheritance Taxation In Oecd Countries Oecd Ilibrary

How The Us Gift Tax Applies To Foreign Nationals Bny Mellon Wealth Management

Report Requirements Template Professional Invitation Letter Sample New Formal Letter Business Letter Template Formal Letter Template Email Wedding Invitations

Taxes On Money Transferred From Overseas In The Uk Dns Accountants